Empowering Consumers and Defending Fairness

We are a team of professionals on a mission to level the playing field for individuals and families. We are working to simplify the specialty credit report process.

Start My Request for a

Specialty Credit Report

Request My Credit Report

Credit reporting agencies compile, maintain, and sell records about consumers. Upon request, these companies must provide a copy of your credit report file.

Review My Credit Report

Request your credit report file. Upon delivery, review your credit report file to make sure there are no inaccuracies or errors.

Correct My Credit Report

Review your credit report file. If you determine there are inaccuracies or errors, file a dispute with the credit reporting agency to correct the information.

Five Areas of Data

Used by Specialty Credit Reporting Agencies

Medical Records or Payments

Medical records or medical payments obtained from medical care providers or insurance carriers.

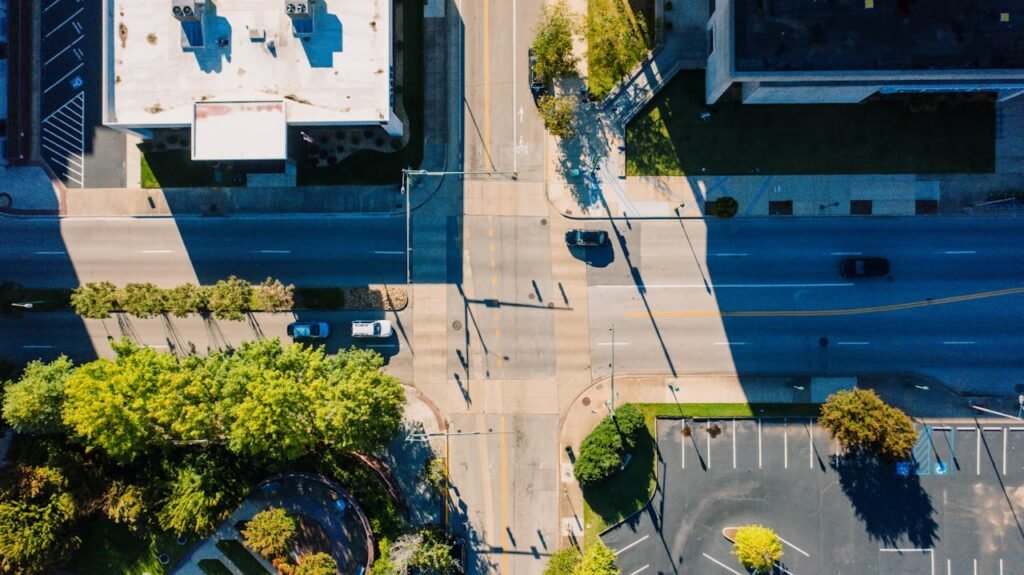

Residential or Tenant History

Residential or tenant history from landlords, payment records, civil records, and court records.

Check Writing History

Details from banking providers, including active accounts, check writing history, daily account balances, and deliquent accounts.

Employment History

Employment history and active employment information provided by employers, including job title, salary, paycheck frequency, and benefits details.

Insurance Claims

Insurance history, including policy coverages, premiums, claims filed, and claims paid. Includes personal/ property insurance, life insurance, and automobile insurance.

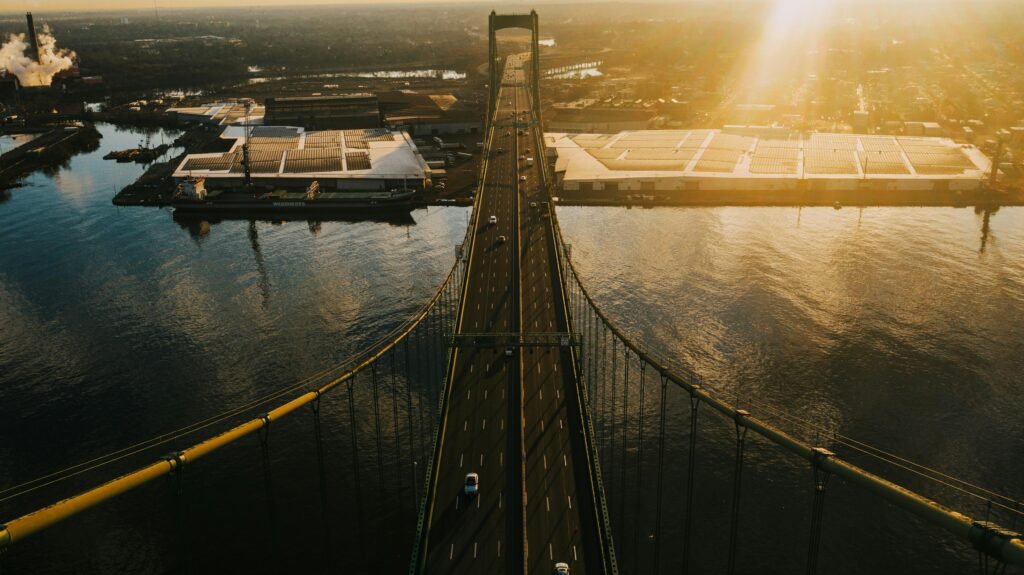

Take Control of Your Economic Identity

Specialty credit reports are essential for employment, housing, banking,

telecommunications, utilities, and insurance (life, auto, and health).

Request, review, and correct your credit files today.